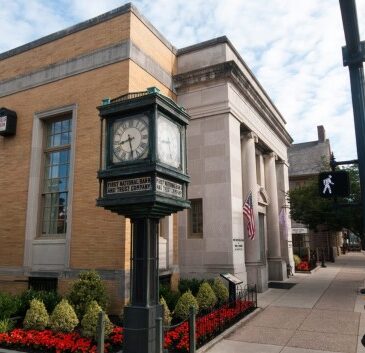

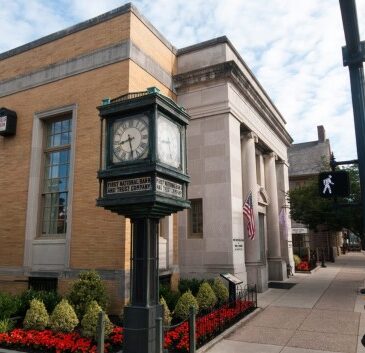

Why You Should Choose An Independent Bank

Also known as a community bank, independent banks are locally owned and operated, with deposits staying in the area as loans to small businesses,...Read More

The online banking portal has been enhanced with a fresh redesign. To read about some key changes, click here.

Also known as a community bank, independent banks are locally owned and operated, with deposits staying in the area as loans to small businesses,...Read More

We are all familiar with the struggles of recent inflation, as we see more and more of our hard-earned money go to pay for...Read More

Born between 1997-2012, Generation Z has grown up in an increasingly connected world of smartphones, Wi-Fi, and social media. They are also on track...Read More

As of 2023, there are over 308 million social media users in the US alone. But as a result of the continued growth of...Read More

As more small businesses move towards an increasing reliance on technology, the risk of becoming vulnerable to a cyber attack also grows. From digital...Read More

The internet can be overwhelming, with new technologies changing all the time. No matter how safe you try to be, sooner or later you...Read More

Cloud storage is a digital service that allows you to store your digital information, including documents, images, videos, and other files, on servers usually...Read More

Are you a financial wiz or a work in progress? Making the best decisions about your money takes practice. You can read financial planning...Read More

From the desk of Ryan Morris - Information Security officer, The First National Bank and Trust of Newtown, PA Cyber attackers are constantly innovating...Read More

As we discuss in our post, 6 Habits of Successful Savers, finding the right vehicle for your savings is one of the most important...Read More

You are now leaving The First National Bank’s Website. Please be aware that by clicking on this link, you will be entering another website. The First National Bank is not responsible for the content on other sites. Other websites may treat information they learn about you differently. Thank you for visiting The First National Bank’s Website. Do you wish to continue?