What do applying for a job, finding an apartment, and borrowing money all have in common?

A good credit score.

If yours is low, either because of past mistakes/misfortune or you’re too young to have built much of a credit history yet, fixing it will take a little time but it’s completely doable. And as your longtime Bucks County community bank, we want to help.

The first step is to learn about how your credit score is calculated and what you can do to raise it. Keep reading for actionable steps you can start taking today. If you have any questions about your specific situation, our friendly and knowledgeable employees are always happy to help. Contact us anytime!

What is a credit score?

Your credit score is a number between 300 and 850 and is usually generated by FICO® —a company that develops software used in determining credit scores. Your score is calculated based on your credit history (or credit report) and is designed to predict your risk of being unable to meet your credit obligations within 24 months after the score is generated. Your credit score is important because it can be a major consideration when you apply for loans, rent an apartment, or complete a background check for a new job.

It’s important to note that “free credit score” apps like Credit Karma and Credit Sesame don’t give you access to your FICO® score. Instead, they provide an estimate of your score based on one or two of the three major credit reporting bureaus.

Some credit card accounts will provide your FICO® score at no charge as a cardholder benefit. You can also buy a report with your scores directly from myFICO.com.

If you just want to view your credit report, federal law entitles you to one free credit report per year from each of the three major reporting bureaus.

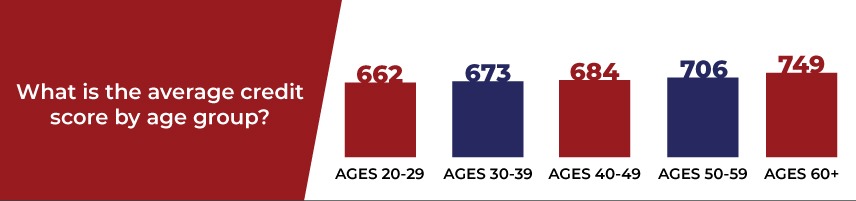

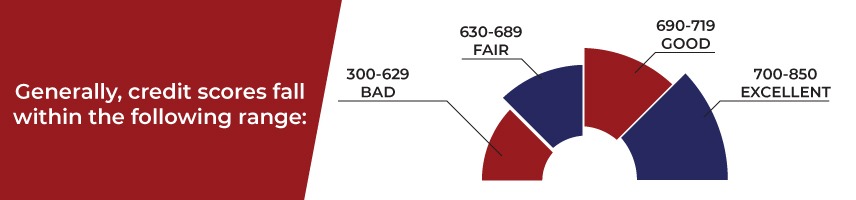

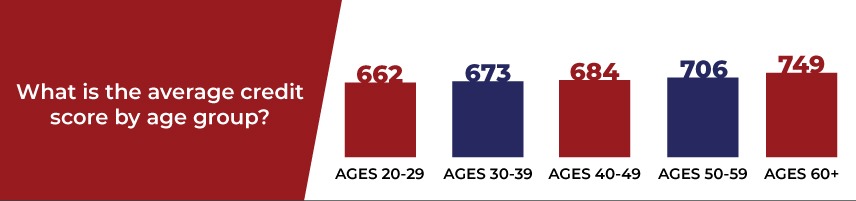

Is there an ideal credit score?

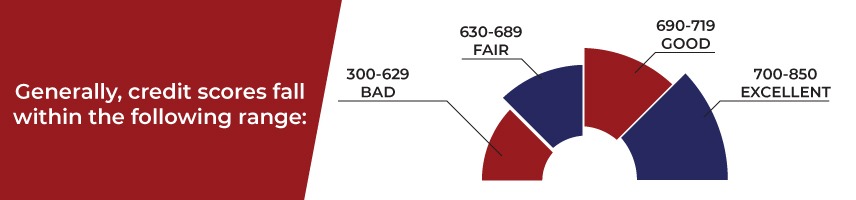

While there are many types of credit scores, they are generally broken into five categories:

- Excellent: 720-850

- Good: 690-719

- Fair: 630-689

- Poor: 300-629

The minimum credit score you need depends on the type of loan you’re applying for. For example, you may be able to get an FHA mortgage with a credit score in the 500s. However, most lenders like to see a credit score of 760 or higher. Anything under 630 is considered low.

My score is below 650. What now?

If you have a low credit score, the good news is that you can definitely bring it back up. Just keep in mind that it will take time–there is no way to raise your credit score overnight. Here are the major categories that affect your score:

Payment History

Making on-time payments is about 35 percent of your FICO score. This means not just paying lenders, such as your mortgage or credit card company, but also utility bills and your rent. If you’re working to rebuild your credit score, make timely payments a priority. You can always ask utility companies or lenders to move your due date if cash flow in different times of the month is an issue.

Credit Utilization

Calculate your credit utilization ratio by dividing your total revolving credit account balances (credit cards or lines of credit) by your total credit limit. For example, let’s say you have two credit cards with a total credit limit of $5,000. You currently have a $1,500 balance on one and a $750 balance on the other. That means your total revolving balance is $2,250 and your credit utilization ratio would be 45 percent. This could have a negative impact on your score, so work on getting your credit utilization below 30 percent. You can do this by making extra payments on your cards or paying more than the minimum payment. While you’re paying down the balance, try to stop using the card.

Length of Credit History

This category is somewhat out of your control, but luckily it only counts for 15 percent of your FICO® Score. The most important factors are the age of your oldest credit account and your newest credit account, as well as the average age of all accounts. A longer credit history generally means a higher credit score. The one thing you can do with this category is to not close a credit account if it’s your oldest one. For example, you could cut up a credit card and stop using it while leaving the account open.

Credit Mix

It may seem counterintuitive, but more diversity in credit type will boost your score. This is because lenders want to see how you handle different types of credit, such as a student loan, credit cards, auto loan, mortgage, etc.

New Credit Accounts and Hard Inquiries

When you’re in the process of applying for a major loan, such as a mortgage, lenders will advise you not to open any new credit accounts in the meantime. The same thing is true of hard inquiries, which is any time you give a lender permission to look at your credit report and score. A flurry of recent inquiries and/or account openings may be a signal of financial distress, so try to avoid doing this if you’re working to raise your score.

The Bottom Line

Some categories weigh more heavily on your score than others. For example, payment history and amounts owed make up 65 percent of the average credit score. That means borrowing sensibly and paying the money back on time can help raise your score.

What else can I do to improve my credit score?

Length of credit history makes up 15% of your FICO score, so there’s a built-in disadvantage to being young. Fortunately, time and good credit habits can help you improve this part of your score.

You’ll also want to avoid frequently opening and closing credit accounts. In addition, you can improve your credit score by limiting the number of revolving or installment accounts you have.

As a rule, try to use just one card for the majority of your credit purchases and maintain one back-up card for emergencies. Remember that “old debt is good debt” when calculating your credit score, so keep your oldest credit card account open and maintain a low debt-to-credit line ratio. For example, some people use a credit card to make the same type of purchase each month, such as gas or groceries, taking care to pay the balance off in full at the end of the month. This is a good way to establish your credit and rehab your score without falling into debt.

The First has a variety of financial solutions for improving your credit score!

Need help digging out from a bad credit score? It can happen to anyone. Or perhaps you simply don’t have much of a credit history yet. Either way, we have a variety of personal loans and credit cards to help you consolidate higher-interest debt, build a credit history, and more. Visit your nearest branch in Bucks Count today or give us a call to learn more!