Beware Online Scams Targeting Seniors

Pennsylvania has the third-highest percentage of senior residents in the country and, unfortunately, scammers take advantage of this. Elders are major targets of online scams because they generally have less knowledge about technology, which makes them easier to trick. They are generally more trusting of online sources, are likely to be lonely and looking for a connection, and are less likely to spot common red flags on fraudulent websites, emails, etc. Unfortunately, it’s difficult to know how many of these types of scams occur because seniors are less likely to report them. So, learn the most common types of online scams targeting seniors and how you can protect yourself or loved ones.

Romance Scams

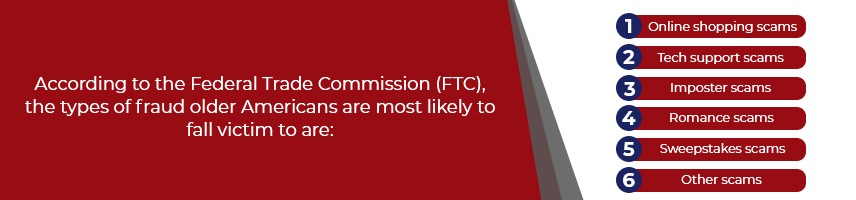

Beware of people you meet on dating websites, especially if you never meet in person and they ask for money. In romance scams, criminals pose as interested romantic partners to take advantage of lonely seniors and get them to send money or other gifts.

Advertising scams

It’s not difficult for scammers to create online ads, product postings, etc. on popular sites like Facebook Marketplace that are designed to get seniors to buy fraudulent products, pay for unnecessary services, etc. This has exploded in recent years due to the pandemic, with some sites or emails offering miracle cures, test kits, vaccine alternatives, etc.

Government/IRS Impersonation Scams

Year round, scammers will pose as IRS agents and other government employees. They use fear tactics and threats of arrest or other punishment in order to get you to give them money right away.

Phishing Emails

A play on the word “fishing,” phishing emails are sent by scammers posing as legitimate companies or institutions to gain your trust and “lure” you into giving up personally identifiable information such as your social security number, account numbers, login credentials, and more.

How to spot a phishing email:

- Is the offer too good to be true?

- Do you feel pressure to take action right away?

- Where does the link actually lead—hover your cursor over it to find out before clicking.

- Don’t open attachments you weren’t expecting. Another type of phishing email prompts you to open an attachment that is actually contaminated with ransomware or other viruses.

- Does anything appear “off” about the email, such as typos that suggest a lack of professionalism, or an email address that is similar but not identical to the actual company’s name?

If in doubt, contact the company in question directly through the official customer service number or email address on their website. If there is actually an issue or special offer, they will let you know.

While phishing typically arrives via email, this common form of online fraud may also be delivered via text message, or phone calls. Learn more about phishing scams in this recent blog article.

Charity, Sweepstakes, and Lottery Scams

Again, preying on their naivety, seniors are often victimized by scams that claim to benefit a charitable cause. This is especially common when a disaster has occurred, like a natural disaster or pandemic that has affected many people. Scammers will use these widely-publicized news stories as a cover for their scam, and seniors will unwittingly contribute their savings to these causes. Criminals may also claim that their target has won a foreign lottery or sweepstake that they can redeem for a certain fee.

Grandparent Scams

This one is particularly vile, as scammers will pretend to be a relative, especially a child or grandchild, in order to gain your trust before claiming to be in urgent financial need. They might reach out through social media, email, or phone and ask you to send them money through online transfers, gift cards, money orders or checks through the mail. The scammer will often ask the target to keep this a secret, so that they can continue to tap them for money in the future.

Malware Scams

Be especially cautious of any attachments on emails, or downloading files from websites. These are common ways of delivering viruses to your computer, or installing a backdoor that will allow online scammers to access your personal files whenever they want. Only download files from sources that you absolutely recognize, and always be extremely cautious even if you think you recognize the source. Be sure to look for red flags on websites and emails that might indicate that you may be dealing with fraud.

Tech Support Scams

Since seniors may not be as familiar with technology as younger generations, criminals capitalize on this by posing as tech support and offering to resolve non-existent technical issues or initiate payments to renew antivirus software. Once they have remote access to your computer, they can steal files and personal data you keep on your computer and use that information to steal your identity and money from your bank account. If you have personal data for any relatives on your computer, they can steal that, too.

What can seniors do to protect themselves from fraud?

- If you recognize a scam attempt once you’ve started communicating with the perpetrator, stop talking to them immediately.

- Search for the offer or business information online to see if others have flagged it as a scam.

- Resist pressure or threats to act quickly. Any reputable company will give you time to consider.

- Never share personally identifiable information—legitimate institutions will never ask for it.

- A request to pay by gift card or wire transfer is another huge red flag.

- Keep your computer’s anti-virus software up-to-date.

- If you encounter a pop-up message or locked screen, disconnect from the Internet and shut down your device.

- Be wary of email attachments and avoid downloading anything that you weren’t expecting.

The First is here to help!

At The First, your privacy and security are important to us. The more you learn about scams targeting seniors, the better protected you’ll be. Visit our Security Center for related topics, find the latest updates from The First, and contact us if you have any questions about your account(s). Helping your parents with their finances or preparing your own estate plan? We are proud to be your trusted community partner for more than 150 years!