The Link Between Physical Health & Financial Well-Being

Physical health and stress are closely linked, with financial stress being one of the most significant contributors to overall stress levels. When financial worries...Read More

The Warminster Branch will be closed for the day on Monday, July 29, 2024 as the parking lot is scheduled to be paved (weather permitting). Please visit us at our Jamison, Doylestown or Richboro Branch instead.

Physical health and stress are closely linked, with financial stress being one of the most significant contributors to overall stress levels. When financial worries...Read More

Newtown, Pa. (June 14, 2024) – The First has been recognized as one of the top-performing publicly traded community banks by American Banker, a...Read More

Whether it’s stretching your toes on a sandy beach or making a moveable feast of a big city’s food truck scene, vacations are a...Read More

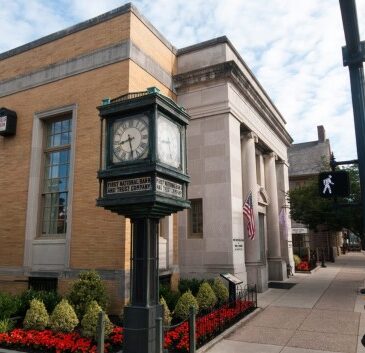

I am writing to you today with immense gratitude and excitement as we celebrate a significant milestone in our journey - the 160th anniversary...Read More

Taking a look around what could be your future home is an incredibly exciting experience and open houses are one of the best ways...Read More

Also known as a community bank, independent banks are locally owned and operated, with deposits staying in the area as loans to small businesses,...Read More

We are all familiar with the struggles of recent inflation, as we see more and more of our hard-earned money go to pay for...Read More

Born between 1997-2012, Generation Z has grown up in an increasingly connected world of smartphones, Wi-Fi, and social media. They are also on track...Read More

As of 2023, there are over 308 million social media users in the US alone. But as a result of the continued growth of...Read More

As more small businesses move towards an increasing reliance on technology, the risk of becoming vulnerable to a cyber attack also grows. From digital...Read More

You are now leaving The First National Bank’s Website. Please be aware that by clicking on this link, you will be entering another website. The First National Bank is not responsible for the content on other sites. Other websites may treat information they learn about you differently. Thank you for visiting The First National Bank’s Website. Do you wish to continue?