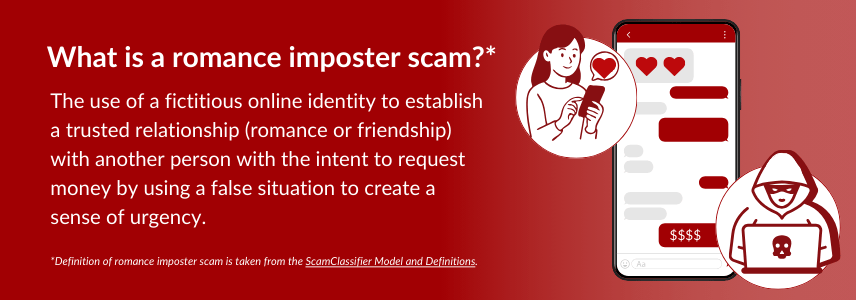

Every year, thousands of people fall victim to romance impostor scams. These scams not only result in significant financial losses, but also can deeply impact the victim’s trust in others, leaving emotional scars that may last a lifetime.

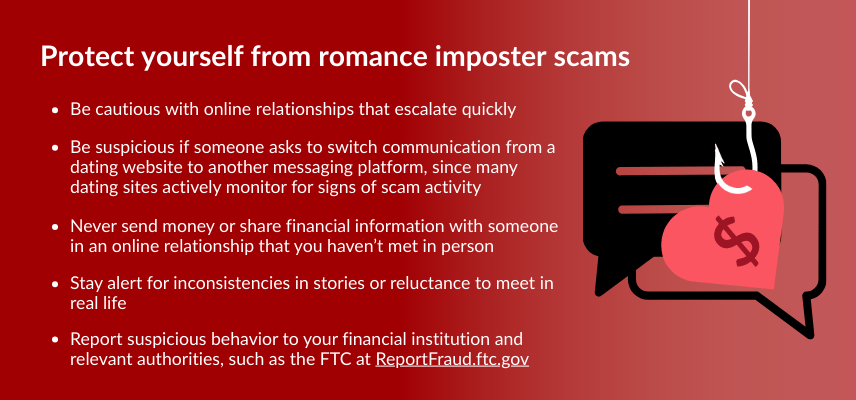

Imagine receiving a heartfelt message from someone who seems to understand you perfectly, only for you to discover later that they are a criminal exploiting your need for love and connection. These offenders are experts at manipulating emotions to gain your trust and, eventually, your money. The financial damage is staggering, with billions of dollars in losses reported year-over-year. However, actual losses are likely much higher, as victims often are embarrassed or unsure about how to report them. Understanding how these scams operate and recognizing their warning signs are crucial to protecting yourself. By staying informed and vigilant, you can help safeguard yourself against these predators. Always verify the identity of the person you are communicating with and never send money to someone you haven’t met in person. Protecting your trust in others and your financial security is of utmost importance.

The Federal Trade Commission (FTC) received nearly 61,000 reports of romance scams in 2024, resulting in total consumer losses of more than $1.2 billion (Off-site).

How Romance Impostor Scams Start

Criminals typically initiate contact through dating sites, social media and gaming platforms, pretending to be someone they are not by creating fake profiles using stolen photos and fabricated personal details. They tailor their personas to match the interests, values or vulnerabilities of their targets, whether it’s love for animals, a recent personal loss or a shared profession. They may seek to appear more credible by impersonating celebrities or professionals, such as doctors, military officers or business executives. They use emails, text messages or phone calls to contact their potential victims with vague messages, such as “Are you there?” or “I can’t make it tomorrow,” designed to spark a response and begin a conversation. The criminal then quickly builds a fabricated relationship to put the victim in an extremely vulnerable position.

The Emotional Manipulation Playbook

Romance scams are built on emotional manipulation. Criminals appear attentive, caring and deeply interested. Over weeks, months or even years, they nurture these relationships, often expressing love early and discussing future plans to create a sense of long-term commitment. Victims often ignore red flags because the relationship fills an emotional void. Romance scams succeed because they exploit a basic human need: connection.

The Ask: The Red Flag You Can’t Ignore

A request for money, no matter how convincing the reason, is the clearest sign of a scam. Stop immediately if someone you’ve never met in person asks for money.

Once criminals feel that trust has been established in the relationship, they use many different approaches to request money, including:

- Travel expenses to visit the victim

- Medical emergencies or urgent home or car repairs

- Business issues

- Investment opportunities promising high returns

- Third-party pleas (e.g., to help a “friend” of the love interest, claiming they’re injured or in need)

These requests are often accompanied by pressure and urgency:

- “You’re my only hope.”

- “I hate to ask, but I have no choice.”

The goal is to make victims feel responsible for the criminal’s well-being and guilty if they refuse to send funds. It is much harder to refuse a request for money when potential victims have invested time and likely developed feelings of love or a close friendship. However, when money is requested, the true nature of the relationship is revealed — this is likely a scam.

Conclusion: Awareness and Prevention

Romance impostor scams follow well-rehearsed playbooks designed to build trust quickly and exploit emotional vulnerabilities. What often begins as casual conversation about shared interests can escalate rapidly into declarations of love and promises of a future together. While red flags may surface, victims often overlook them, driven by a deep desire for connection. The critical turning point comes when the criminal requests money under seemingly legitimate pretenses. This is the moment where awareness can make all the difference. Prevention starts with education, but the real challenge lies in applying that knowledge when emotions are involved. Never send money to romantic interests you haven’t met in person, take time to step back and evaluate the situation objectively, and protect yourself from both financial and emotional harm.

Additional Resources

- Romance Impostor Scams: How Criminals Exploit Trust to Steal Money (PDF)

- Scams Mitigation Toolkit | FedPayments Improvement

- Romance Scams, Check Fraud and the ScamClassifierSM Model (PDF)

- Scams Mitigation Toolkit Module 2: Scam Tactics and Impacts

Getting Help

If you identify suspicious activity involving your accounts with The First, contact us immediately.

We hope you find these tips helpful. If you have any questions or need assistance, please don’t hesitate to give us a call. Stay safe and secure!

For more information to protect yourself from cybercrime, visit The First’s Security Center and review how to protect yourself from account takeover fraud.